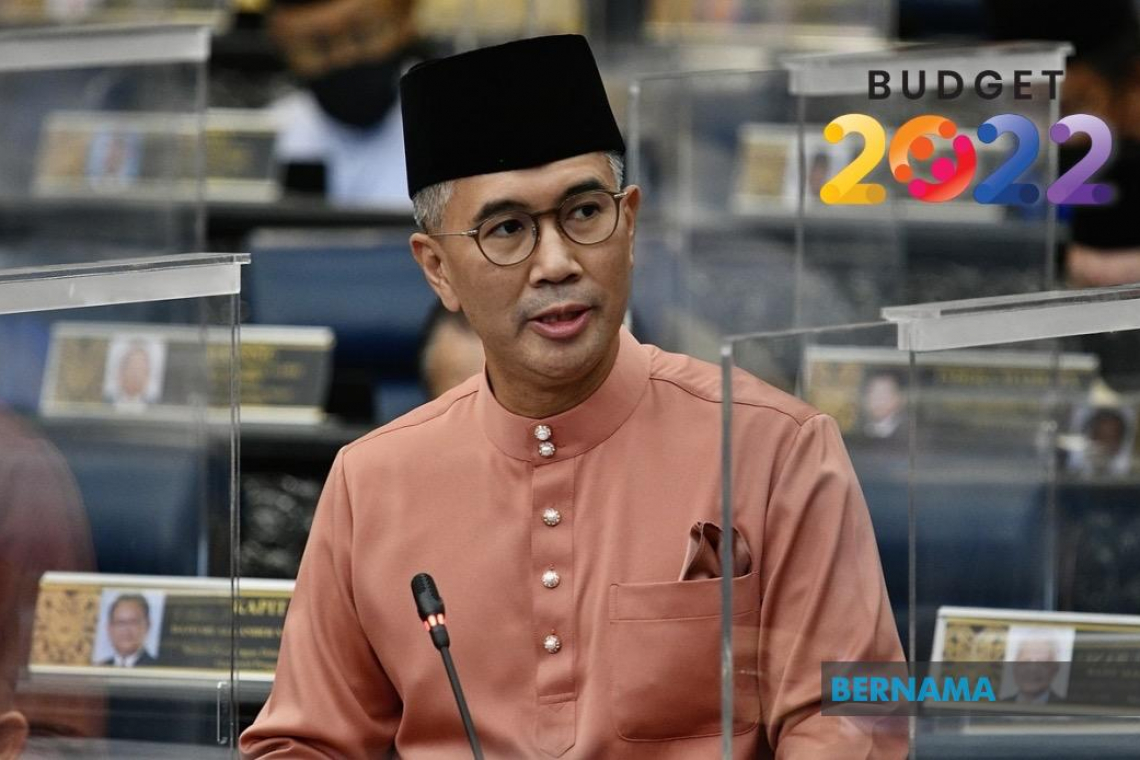

KUALA LUMPUR, Oct 29 – The following are the highlights of Budget 2022 themed “Keluarga Malaysia, Makmur Sejahtera (A Prosperous Malaysian Family)” which was presented by Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz in Parliament today.

The government has allocated a total of RM332.1 billion for Budget 2022, the highest value compared to previous budgets

Government revenue is expected to increase to RM234 billion in 2022

A total of RM233.5 billion is allocated for operating expenditure, RM75.6 billion for development expenditure and RM23 billion under the COVID-19 Fund

RM2 billion is provided as contingeny savings

- Fiscal deficit for 2022 is projected to shrink to 6.0 per cent of GDP from 6.5 per cent in 2021

- The government intends to provide individual tax relief and tax deduction to employers on costs associated with taking self-purchased booster vaccines.

- The KSWP minimum contribution tax reduction period will be extended to nine per cent from 11 per cent until June 2022, involving an estimated value of RM2 billion

- Sales tax exemption of 100 per cent will be extended for Completely Knocked Down (CKD) passenger vehicles and 50 per cent on Completely Built Up (CBUs) vehicles, including MPVs and SUVs for six months until June 30, 2022

- The government provides guarantees of up to RM2 billion to banks through the Housing Credit Guarantee Scheme to provide gig workers, small entrepreneurs and farmers access to financing to puchase houses

- A financing package worth RM40 billion is provided under the Semarak Niaga Keluarga Malaysia Programme

- The government to provide Microcredit financing worth RM1.8 billion

- Loans up to RM10,000 at zero-per cent interest, as well as 12-month moratorium to be offered under the Informal and Micro Financing Scheme

- BSN and Agrobank will offer micro loans of up to RM75,000 at zero- per cent interest, with a moratorium facility of up to six months

- The government will continue the Cooperative Movement Economic Transformation Programme (TRANSFER) with an allocation of RM10 million to restore the affected cooperative activities

- RM30 million will be provided for the Cooperative Economic Recovery Intervention Financing Programme

- The government is allocating RM20 million to support the expansion of the I-TEKAD programme

- A total of RM80 million is allocated through matching grants for the Malaysia Co-investment Fund and an additional RM100 million is allocated for investments by BPMB to further support alternative financing

- Funding facilities worth RM2.1 billion through equity and quasi-equity investments will be introduced to help companies facing gearing or leverage problems.

- BPMB to offer RESET Scheme and BNM will provide a Business Recapitalisation Fund worth RM1 billion

A total of RM14.2 billion of funds to be made available to SMEs

- BNM’s special fund, especially the Targeted Relief and Recovery Facility, has been increased by RM2 billion

- Viable companies listed on Bursa Malaysia affected by the COVID-19 pandemic will receive an injection of additional funds through a government-owned Special Purpose Vehicle in the form of equity instruments or other related instruments

- Khazanah Nasional will be mandated to assist the government in providing the infrastructure to manage a fund totalling at least RM3 billion

Syarikat Jaminan Pembiayaan Perniagaan Berhad (SJPP) to be enhanced through guarantees for scheduled and restructured financing with an additional guarantee limit of RM10 billion

- The government plans to extend the tax deduction for the cost of renovation and upgrading of premises up to RM300,000 until Dec 31, 2021

- Additional tax deduction of up to RM50,000 for companies registered under Safe@Work on the rental expenses of employee accommodation premises extended for another year

- A ‘Business Travellers Center’ will be provided in Johor for short-term business visitors from Singapore at a cost of RM10 million

- Deferment of income tax installment payment for MSMEs for six months until June 30, 2022

- All businesses are allowed to amend the estimated income tax payable in the 11th month before Oct 31, 2022

- RM25 million is allocated to explore high-impact investments and export markets through the Trade and Investment Mission

- A special strategic investment fund of up to RM2 billion is provided to attract strategic foreign investment among multinational companies

A total of RM80 million will be provided through MITI to train 20,000 employees who support industry clusters such as MRO in Subang, E&E in Kulim and chemicals in Gebeng

- RM50 million is provided through the state skills development centre to improve TVET skills

- A matching grant of RM100 million is provided for Bumiputera SMEs to explore business opportunities in the aerospace field

- RM25 million is allocated to Halal Development Corporation to produce more halal MSMEs

- RM30 million will be provided to implement the Innovation Hub: The Fourth Industrial Revolution

RM20 million is allocated to the Cradle Fund to intensify efforts to rehabilitate and build the resilience of startup economies

- RM45 million is allocated to encourage technological transformation towards the Fourth Industrial Revolution

A collective fund of RM500 million is allocated through the GLC Network initiative: Empowering MSMEs to assist entrepreneurs through advisory services and financial support

- At least RM30 billion will be allocated for capital expenditure and investment next year

- The government will issue Sukuk Kelestarian in ringgit of up to RM10 billion to be channelled to eligible social or environmentally friendly projects

- The government will continue with the implementation of national infrastructure development projects worth RM3.5 billion, including the construction of the Pan Borneo Highway and Central Spine Road.

- An initial fund of RM200 million is allocated through the creation of the Third Infrastructure Facilitation Fund to further boost high-impact infrastructure development activities in collaboration with the public and private sectors.

- The government intends to introduce the Fiscal Responsibility Act to improve governance, accountability and transparency in the country’s fiscal management.

The government is conducting a Public Expenditure Review in collaboration with the World Bank to ensure the efficiency and effectiveness of public spending without compromising the public delivery system.

Contract stamp duty rate increased to 0.15 per cent and RM200 stamp duty limit per contract note abolished, while listed stock trading brokerage activities are no longer subject to service tax

Income tax imposed on Malaysian residents on income derived from foreign sources and received in the country from Jan 1, 2022

Sales tax levy to be imposed on low-value goods from abroad sold by online merchants and sent to consumers in Malaysia via air courier services

Government plans to introduce a special one-off tax, a “prosperous tax”, on high-income companies

Service tax is levied on e-commerce platforms except for food and beverages delivery and logistics

Tax identification numbers will be implemented from 2022 to broaden the income tax base

The government will publish the Tax Expenditure Statement in an effort to improve fiscal discipline and transparency, as well as complement the Medium-Term Revenue Strategy programme, as well as the tax incentive study that is being undertaken

https://www.mof.gov.my/portal/en/news/press-citations/budget-2022-highlights-summary

0 Comments